Nowadays, practically anything can be done online. You might be able to find a car, do your grocery shopping, and even make doctor's appointments from your smartphone or computer! So why shouldn't you be able to submit an application for a Florida title loan online? From the convenience of your home, you may now apply for a title loan. Simply use your computer or smartphone to access the short inquiry form. Alternatively, if you'd rather have that kind of easy access and contact, give a title loan representative a call!

Table of Contents

What is Florida Title Loan?

Car Title loans amounts, rates and terms may vary from state to state depending on their laws and regulations. An Online Florida Title Loan provides the state’s residents with instant cash against the equity of their vehicle. Your loan amount is determined on the basis of your vehicle’s value. On average, Car Title Loans range from $250 to $10,000.

Florida Car Title Loan Rates and Terms

The main points every borrower should clarify in the first place are the sum and the cost of the loan. Though there’re general ideas concerning Title Loans online it’s always a good idea to double check and specify your location to get the details on your state’s Car Title Loan. Besides, the terms and rates should be previously discussed with the lender as they may vary.

Getting Car Title Loans in Florida – all the process from start to finish

Step 1: Apply Online using a free and clear vehicle title in your name

Step 2: Get your vehicle inspected either online with the help of photos and videos or bring it to a loan store.

Step 3: Get your application reviewed and instantly approved.

Step 4: Get the funds immediately.

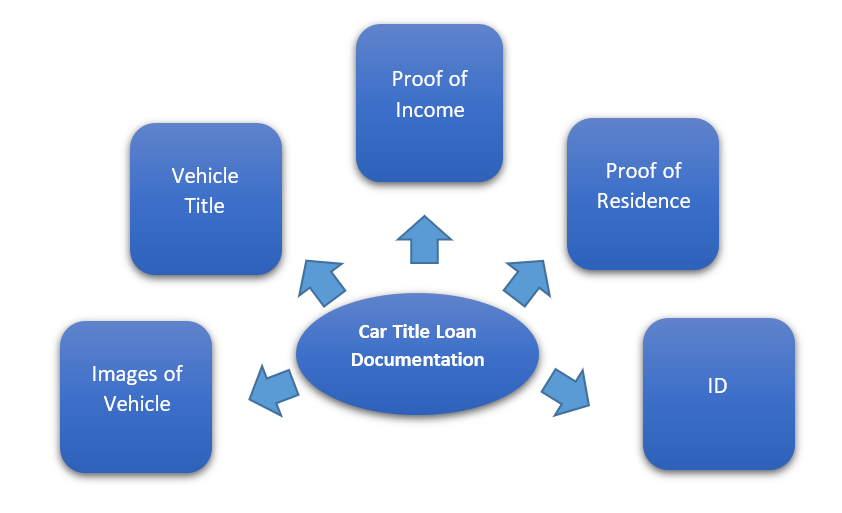

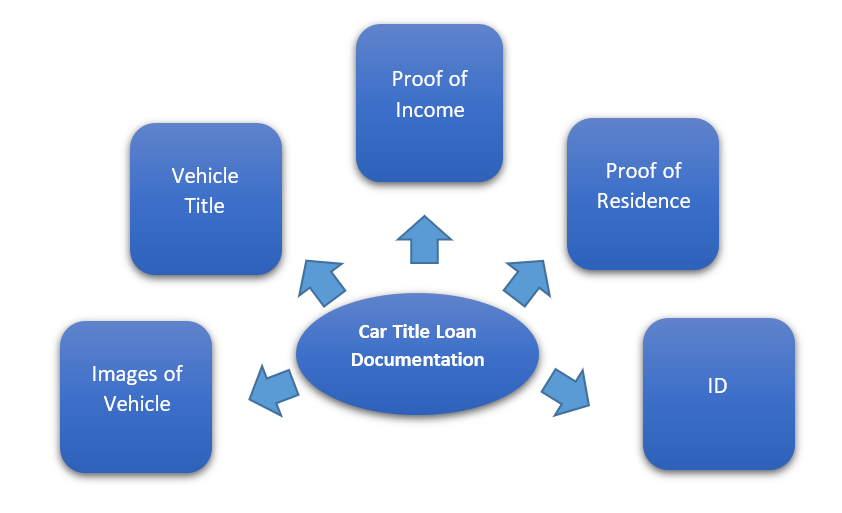

The documents you need to apply for a title loan in Florida

You will need to have a few documents on hand when applying for any kind of loan option in order to possibly be approved. These documents can be readily filed online for your convenience. These documents may differ, however as a resident of Florida, you can expect to need:

-

Proof of Income: You'll need to demonstrate that you have the financial means to repay the loan. Although you do not require a certain kind of income to qualify, you will need to provide documentation of an acceptable source of income. It is possible to accept a wide range of alternative forms of income, including worker's compensation, settlement income, and disability payments. If you want to learn more about the different forms of income that are allowed, speak with a title loan representative.

-

Proof of Residence: You must present some documentation to establish that you are a resident of Florida and that your car is registered there. A recent credit card statement or an energy bill is typically provided by borrowers.

-

Vehicle Title: In order to obtain finances, you must present a car title if you are not currently financing a vehicle. At the time of the investigation, the title to your car must be in your name.

-

Images of the vehicle: You can avoid the necessary vehicle inspection when you meet the requirements for a title loan, which is another convenience. You can skip the in-person inspection process by sending a few pictures of your vehicle! Simply snap a few quick pictures of the sides, rear, and front of your car, as well as the odometer readout.

-

ID: You must provide identification issued by the government or the state to substantiate your loan application. When a title loan representative asks you to establish your identification, bring your passport, driver's license, or even your real ID.

What are the advantages of taking out a car title loan online in Florida?

A Florida title loan can be obtained almost entirely online. Ask questions, transmit documents, and even get money without leaving your house. If necessary, you can even seek information on your automobile title online and transmit it virtually to your title loan lender.

Is your title giving you any trouble? Don't worry! The team that can help you apply for a title loan is also prepared to assist you in resolving a variety of title-related problems.

Can I Get A Car Title Loan in Florida if I Have Bad Credit?

“Sure, Yes”! That’s what car title loans are designed for – to let even bad credit borrowers receive emergency financing using the car title instead of perfect credit history. Lenders use the value of the car to determine how much they can offer to these applicants with no risk either for themselves or for the borrower.

What other things make Florida Title Loans a good pick?

Maggieloans offer a unique lending experience like no other company:

-

A few Minute Loan Process – from Start to Finish

-

Fast & Easy Approval

-

No Credit Check

-

Low Monthly Payments

-

Same Day Funding

-

Keep Driving Your Car

-

No Prepayment Penalties

Our auto title loans are the most affordable loan option that can get you the cash you need, fast!

How much money can you obtain with a car title loan in Florida?

If you live in Florida and are considering applying for a title loan, you might be wondering how much money you could borrow. In Florida, the criteria that determine your loan amount and loan eligibility are coincidentally the same!

The following two elements will be most important when you apply for a title loan in Florida:

-

The Price of Your Car

-

Your Florida Monthly Income

In Florida, collateral is used as security for title loans. Your loan amount in Florida may be bigger the more equity you have in your car to draw from and the higher your monthly income is! In Florida, the majority of approved borrowers typically have access from 25% to 75% of the value of their vehicle. In Florida, you might be able to convert the market value of your car into usable cash.

What happens if I fail to repay the title loan in Florida?

The normal repayment period for a car title loan is 30 days. If you don't pay it back on time, the lender has the right to lawfully seize your vehicle, offer to buy it back from you, and then sell it to make up any losses. This is what will take place:

|

Repossession

|

After you schedule an appointment, your Florida lender will be obligated by law to provide you the option of bringing your automobile in yourself. If you don't show up for that appointment, they can send a DMV agent to your house to take the car back. Before they take the car, they must allow you adequate time to remove any of your personal goods.

|

|

Selling Your Car

|

Once the lender obtains control of your car, they are free to sell it to recoup the loan's remaining sum. In order to offer you another chance to repay the debt, they are required by law to provide you a 10-day notice before the sale takes place. You may also purchase the vehicle's title back in the sale in accordance with Florida title loan regulations. This can be the most affordable choice if you have repeatedly extended your loan.

The proceeds from the sale must only be used by the lender to pay off any outstanding debts and other expenses related to having to seize and sell your car. If after paying these costs there is any money left over, it must be given to you within 30 days of the original sale. The lender will be responsible for covering all of your legal costs if you have to sue to recover this money.

|

Does applying for a Florida Title Loan impose any obligations on me?

“No, filling out an online Title Loan application form doesn’t make you obliged to take out the loan”. It just lets you check if you qualify and check your rates and loan amount. There’s no obligation, no need to pay anything, and no damage to your credit score either.

Is There a Car Title Loan Center Near me in Florida?

No doubt, it’s more convenient to apply for a Car Title Loan online. But for faster access to cash, you may need to visit the company’s store.

FAQ Title Loans in Florida

How do Florida Title Loans work?

When applying for a Title Loan in Florida, you must transfer your car title to the lender who gives you the money. Thus, the Title Loan is secured and your car is a collateral. After the loan is paid off, your title is returned to you.

How much can I get with Florida Title Loans?

A Title Loan in Florida gives you the option to get 25 to 50 percent of the value of your car. Since cars are differentiated by make, mileage, age, and so on, you can get from $ 100 to $ 5,000, in some cases up to $ 10,000.

What are Florida Title Loan requirements?

In order to obtain a loan in Florida, you will need to provide the lender with the necessary documents. The main ones are the original name of the car and its title, insurance and registration of the vehicle, proof of your income and government-issued ID.

How to get my car title back in Florida?

When the Title Loan is paid, the lender is the owner of your title. Everything you need to do in order to get the title back is to repay the loan with interest, after that the title will be returned to you according to the terms of the contract.

How long does it take to get approved for a Title Loan in Florida?

As a rule, the Title Loan in Florida is approved within one business day. You bring the car to the title lender, then the vehicle is assessed, and after that you can sign the contract and receive the money.