Not paying attention to growing costs and complicated political and economical situation, Americans tend to spend more on travelling and vacation.

According to the data from Allianz Partners USA’s 14th annual Vacation Confidence Index, US residents have spent 26% more money on holidays in 2022 in comparison with the previous year. It is approximately $2,644 on average which is 30% increase since pre-pandemic 2019 year. Check the table below to see how much the average cost of vacation has been changing since 2020:

Inflation as the main reason for the Growing Travel Costs

Experts name two main reasons for the increasing prices on travelling and vacation. They are –

- High inflation

- Boosting demand for vacation after a few years of COVID restrictions

Inflation has reached its peak accelerating to 9.1% in 2022 which naturally led to the rise of all prices. Especially, we need to take into account the prices of gas. Travelling can’t be imagined without using some type of transportation. So, a substantial part of vacation cost is taken by gas cost which is much higher nowadays.

For more than 2 years people have been restricted from travelling and they are really eager to come back to spending vacations as at prepandemic years. It explains the boost of demand for travelling no matter what the cost is. Some of them have saved for travelling for a long time, others are ready to apply for a loan but have a vacation of their dream at last.

How much does an average summer vacation trip cost?

Based on the data from a travel insurance provider Squaremouth, the average vacation price is about $6,0oo within the country, and $5,300 for abroad trips.

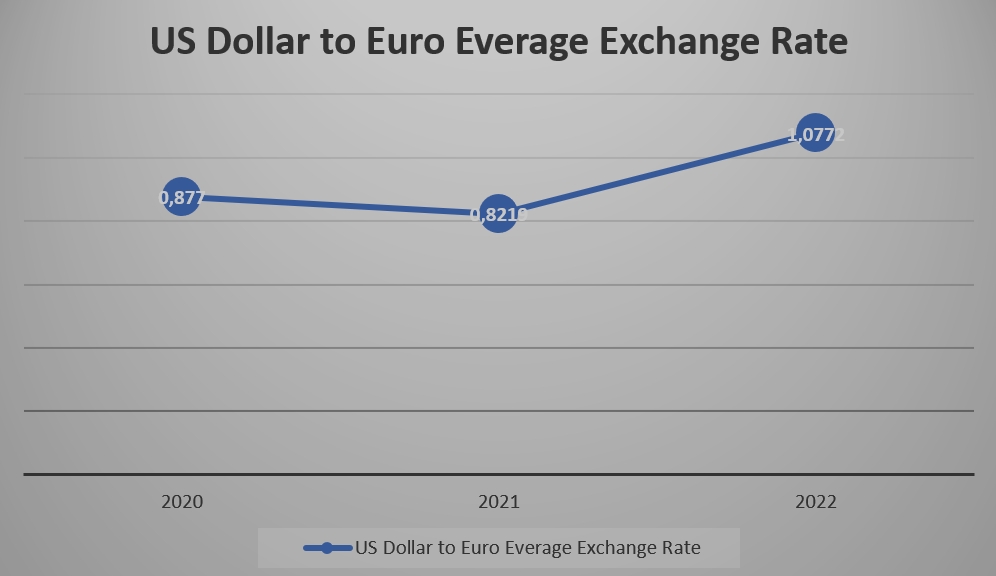

You may wonder why international travel costs almost $7oo less than a domestic one. It can be explained by the euro exchange rate which has almost equaled the US dollar in 2022.

Today is the most suitable time for Americans to travel to any of the 19 countries of the EU. They can save up to 15% compared to the year of 2021.

While a falling euro exchange rate is greatly beneficial for US travellers, they still come across the increasing prices caused by inflation. Europe as well as the USA has also suffered from inflation together with higher energy costs, food prices, etc.

Besides, the statistics show that most Americans choose to travel within the country, only 40% of US residents have left the country for holidays.

How to take advantage of falling euro exchange rates

-

If possible, try to use a credit card without a foreign transaction fee. You’ll be able to save 3% on those fees. -

If you have, take your backup credit card just in case some places don’t accept your primary one.

If you book in advance, you’d better make payments now while the exchange rate is low.

If you prefer to pay by cash, exchange it when needed, nor beforehand.

-

If you need to withdraw cash from ATM, do it in the USA at better rates.

Use the vacation loans only in case of real necessity.

-

Plan your budget so that you were sure to repay the money on time.

-

Compare the offers and check your rates at first.

Choose the most convenient repayment terms with flexible schedule.

Most experts recommend taking out unsecured personal loans for vacation financing. They are cheaper than credit cards or secured loans with a risk of losing some of your assets.

Vacation Loans

As research shows, about $2,000 is needed to cover holiday costs. It can turn out too expensive for those 40% of Americans who fail to find 400 dollars to cover emergency expenses. Vacation loans are one of the options to find financing for them.

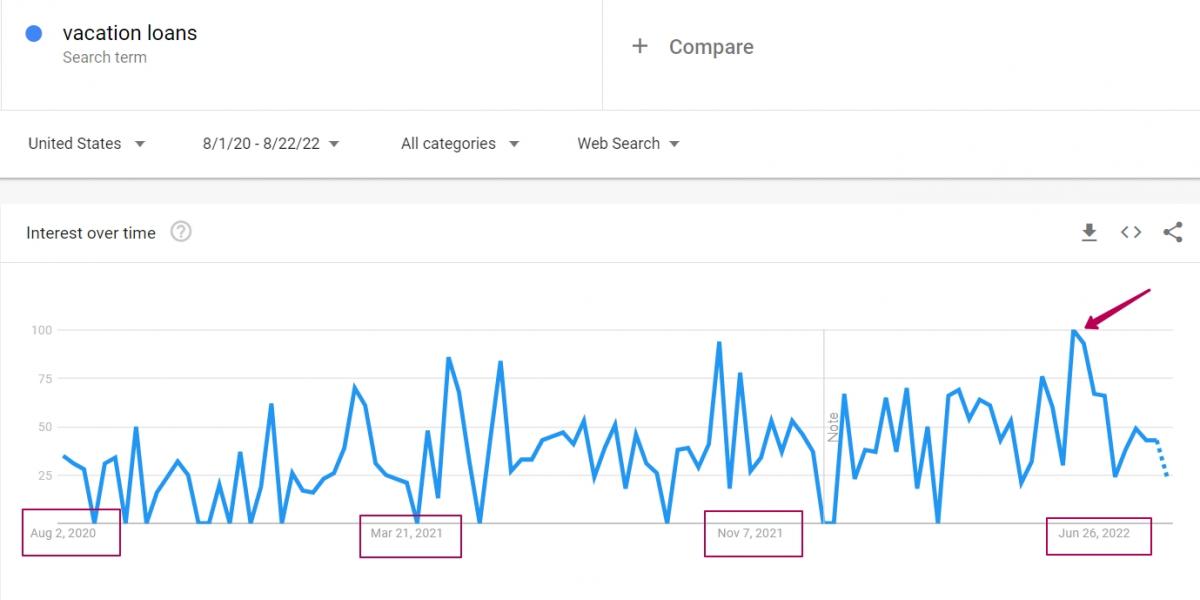

The popularity of “Vacation Loans” is never falling down which can be proven by the diagram before:

However, you need to take into account a few things before applying for a personal holiday loan.

- Use the vacation loans only in case of real necessity.

- Plan your budget so that you were sure to repay the money on time.

- Compare the offers and check your rates at first.

- Choose the most convenient repayment terms with flexible schedule.

- Most experts recommend taking out unsecured personal loans for vacation financing. They are cheaper than credit cards or secured loans with a risk of losing some of your assets.

Let’s sum up the benefits and drawbacks of Personal Loans for Vacation financing.

|

Advantages |

Disadvantages |

|

|

Other Ways to Finance Your Vacation

If you have no savings and prefer to avoid borrowing money to cover vacation costs, you can still consider some alterative options to get the funds:

- Credit Card travel rewards.

-

Home Equity Loans or HELOC.

-

Plan your budget beforehand and save.

Look for cheaper ways to spend your vacation – discounts, special offers, etc.

Summary

Though you are going to spend a way too much on your vacation, this is the time you deserve. And it’s worth of taking out a loan if there’re no other options.

Find out as many as possible details about your trip and you’ll be able to cut down on the costs substantially.

Enjoy yourself, and for the next time try to save in advance.