A personal loan is a loan to a consumer for non-business purposes. This is either a loan from a bank or a loan from private individuals. In the second case, the loan is given to the borrower by private lenders via a special brokerage platform or directly by a private lender. Such a private loan is particularly suitable for consumers who find it difficult to get an installment loan from a bank. Consumers can use Maggie Loans to compare numerous personal loans, especially from banks, in a neutral manner. You will find low interest rates in the personal loan comparison, you will receive personal advice and you will receive some loans particularly quickly thanks to the fully digital conclusion and immediate payment.

What Is A Personal Loan?

As mentioned above, a personal loan is a loan to consumers for non-business purposes. However, the term hides two ways of getting money.

On the one hand, a personal loan is a loan from a bank to a private household or borrower, i.e. a normal consumer or installment loan.

On the other hand, the term personal loan refers to a consumer loan from private individuals – i.e. a loan from private individuals. This can be one or more private lenders. Loans from several lenders are brokered to a consumer via special online platforms that bring borrowers and lenders together. These platforms are also called P2P lending platforms and are different than loan comparison portals. In addition, a private loan can also be granted directly, for example between family members or acquaintances.

Compare $20,000 Personal Loans Online and Save

20,000$ personal loans are available for loan periods of different lengths, different interest rates and installment amounts. Before making a commitment, the lender or lenders usually check the creditworthiness of the applicant by assessing his financial situation based on his documents. The borrower usually has to repay a personal loan in equal monthly installments.

$20,000 Personal Loan Calculator

With online personal loan calculator, you can calculate a personal loan in different ways - you can choose to determine the monthly installment, loan amount or term by entering different parameters.

- The credit from private

An alternative to banks are private lenders. These can be particularly relevant for groups of people who find it difficult to get a loan from banks, for example because of their low or extremely fluctuating income. A private loan can be concluded in the two ways described below.

- Special mediation platforms

Loans from private individuals are available through brokerage platforms. These special online platforms are different than comparison portals. They are also known as P2P lending platforms. P2P stands for "Peer to Peer". The private lenders who lend money through such platforms are usually consumers who want to invest their money in this way and earn an income from providing personal loans. A private loan is usually financed by several investors. The intermediary checks the creditworthiness of the applicant before awarding the contract. A private loan is often granted at a higher cost than with a bank.

- Directly from private individuals

People from the personal environment can also be lenders. In this case, a private loan is paid directly to the borrower by a private individual, such as a family member or friend. A credit check does not take place. In addition, this is not a regulated market. Borrowers and private lenders are free to negotiate the amount of personal loan interest, term, repayment method and other conditions.

In order to avoid conflicts between both parties until such a loan has been fully repaid, it is advisable to conclude a written loan agreement for this type of personal loan as well.

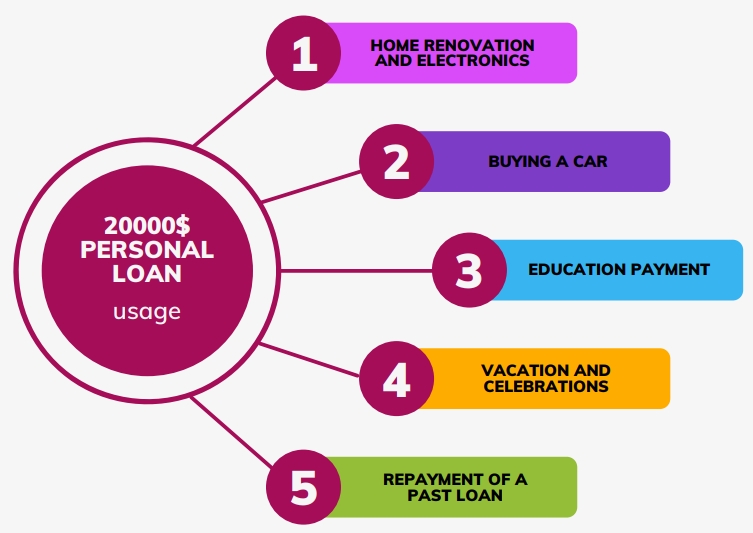

What Can I Use A 20000$ Personal Loan For?

A personal loan is usually granted for free use. Both a personal loan and a personal loan from a bank can therefore be used to finance a wide variety of goods such as furniture or consumer electronics or for services or activities such as vacations.

There are also personal loans with special purposes for certain purchases, the most important of which is the real estate or mortgage loan. With such a personal loan, the borrower can only use the borrowed money for the stated purpose. The same applies to a personal loan that the borrower takes out specifically for a debt restructuring. Here, the borrowed money is used to replace an existing loan.

How much does a 20,000-dollar personal loan cost?

The total cost of a personal loan consists of the amount borrowed and the costs to be paid over the term. Banks are not allowed to charge additional processing fees. The comparison and conclusion via comparison portals is free of charge for the consumer. Some online P2P lending platforms charge a referral fee. How much a personal loan costs in detail depends primarily on the annual percentage rate, which, unlike the borrowing rate, includes all the costs of the loan.

Basically, the lower the effective annual interest rate, the lower the total costs with the same loan amount. The shorter the term, the higher the monthly installment, but the lower the total costs with the same net loan amount and the same interest rate.

Factors That Also Affect The Cost Of A 20000$ Loan

- Lender

Personal loans from banks are usually cheaper than loans from private lenders concluded via brokerage platforms. This is because a private loan via such platforms is also given to people with a comparatively low credit rating. How high the interest rate depends on the risk class into which a borrower is classified by the operator of the platform depending on his creditworthiness. The conditions of loans from individual private individuals are freely negotiated, which is why no generally valid statement can be made about their amount. Banks are no longer allowed to charge borrowers a processing fee. However, special brokerage platforms for private loans often charge a brokerage fee. The borrower must bear this in addition to the interest.

- Borrower

All consumers want to take out the cheapest possible personal loans, but not everyone gets a loan on the same terms: some banks grant loans at interest rates that depend on their creditworthiness; Borrowers with very good credit ratings get the cheapest personal loans there. In the case of offers for a loan with creditworthiness-dependent interest rates, a so-called two-thirds interest rate is always given in addition to the interest rate range. At least two thirds of the borrowers receive the personal loan at this or a cheaper annual interest rate.

- Purpose of use

For loans with special purposes, the annual percentage rate is usually lower than for loans for free use. This is because the bank usually requires additional collateral for a special purpose loan.

What Credit Score Is Needed For A $20000 Personal Loan?

Many believe that a loan as large as $20,000 requires a perfect credit history. This is how it works in banks, but private lenders always try to find a compromise with the client and do not pay attention to your past credit history. You just need to provide proof of income, which shows that you will be able to pay such an amount. You can easily turn to such a private lender as Maggie Loans and not be afraid to be denied to take out a 20,000$ loan.

What Is The Monthly Payment For A $20000 Loan?

Typically, personal loans for this amount are repaid from 2 to 7 years. Of course, you can always agree with the lender for the most comfortable terms for you. Many mistakenly believe that it is better to repay a loan for a longer period. Paying off a personal loan over a long period of time seems attractive at first glance since the rates are comparatively low for the long term. However, this increases the overall cost of the loan because the interest is always calculated on the remaining debt. That is why, if you have the opportunity to pay 20,000$ in a shorter period, it is better to do so.

What Is The Interest Rate On A $20000 Personal Loan?

As for the interest rate, it can differ significantly from case to case. Firstly, the interest rate will be much higher if you are a high-risk client. Such a client is a person with a bad credit history who does not give the lender any guarantee that he will repay the loan. Secondly, the fact that you leave collateral affects the interest rate. That is, even if you are a client with a bad credit history, but leave a vehicle as collateral, the lender will significantly reduce the interest rate for you.

Where Can I Get Online $20000 Personal Loan?

As mentioned above, there are several ways to get a loan. The most popular today are online loans, for which you do not even need to leave your house. To obtain such a loan, you need to choose a lender such as Maggie Loans, for example, fill out a form on the website and wait for a positive response.