Table of Contents

Online Installment Loans in Texas

Do you need urgent money? Here you can get Online Installment Loans in Texas from a reliable lender in 24 hours. Our Online Installment Loans will help you cope with a difficult financial situation.

If you take No Credit Check Installment Loan in Texas, please contact us immediately. We work only with direct lenders that have the state's license to offer Installment Loans to Texas residents.

Our professional team works for you 7 days a week. You can contact us at any time and ask all your questions about Online Installment Loans.

What is Texas Installment Loan?

Online Installment Loans in Texas differ in terms of maturity, interest rate, and loan amount.

-

The maturity of the loan. The standard maturity of Online Installment Loans in Texas is 12 months. You can also take out such loans for 6 months. If you get paid every month, you will end up making 11 payments. If you get paid every 2 weeks, you will end up paying 23 payments.

-

Interest rate. The annual interest rate is individual and varies depending on your specific characteristics. For example, the interest rate depends on your credit history. All Online Installment Loans have higher interest rates than regular loans. Therefore, they are not suitable for needs that require long-term payments.

-

Loan amount. The loan amount, as well as the interest rate, are individual indicators. The allowed loan amount depends on the amount of your income.

Installment Loan Rates and Fees

Installment loan Calculator

This calculation is just a representative example. The estimates are preliminary and may vary in some cases. You'd better get advice from a finance professional. Using this calculator isn’t a guarantee that you will be eligible for a loan. Your lender will need to approve you.

APPLY NOW

Texas Installment Loans with No Credit Check

It's quick and secure to apply for a Texas Installment Loan online with trusted lenders. Funds are normally paid into your bank account the following working day if you are authorized.

As you advance in your credit journey, you can potentially qualify for lower credit costs or bigger loan amounts based on your consistent payment history.

In Texas, you may borrow between $1,000 and $5,000 for an installment loan. After lenders have examined your application, they will let you know whether you've been accepted and how much you might be eligible for.

The specifics of your loan, which are described in your loan agreement, will determine the cost of your loan, including the annual percentage rate (APR), payback amount, and payment schedule. This loan is a pricey kind of credit and is not meant to cover ongoing expenses. Please use this product properly.

How to Apply for an Installment Loan

In order to submit the essential information, prospective borrowers will either interact with a customer care specialist or apply online.

Customers who take out installment loans must be able to pay back the loan. Lenders are extremely proud to be able to meet your demands. They also want to make sure you never find yourself in a situation where you are unable to make loan payments. The inquiries they make over the phone or in an online application are intended to both help and protect you. Apply online right away or get in touch with a member of the customer care team!

How to get Online Installment Loans in Texas?

-

Apply online.

-

Get instant approval.

-

Receive your money within 24 hours.

Online Installment Loans in Texas - requirements

To get Online Installment Loans in Texas, you must:

-

Be a resident of Texas.

-

Be of age.

-

Have a permanent source of income.

-

Have an active Bank account.

-

Be a permanent resident or citizen of the United States.

-

Have an active email address and a valid contact number.

The benefits of obtaining an installment loan

Lenders are aware that emergencies do occur. If you find yourself short on cash and need to cover expenses right away, an installment loan might be the solution. You can wish to apply for an installment loan for the following reasons:

-

Automobile Costs

-

Emergency Money

-

Unexpected travel costs

-

Defaulted Utility Bills

-

To evade having to pay overdraft fees

Can a person with bad credit get an installment loan in Texas?

You can obtain quick cash by applying for same-day or immediate loans. These same-day loans are installment loans that enable you to quickly obtain the funds you require. After then, you pay according to a set period, usually within several months.

But do guaranteed installment loans exist for people with bad credit? Though they do exist, guaranteed or secured loans for those with bad credit are significantly riskier than unsecured emergency loans. While missing payments on an unsecured loan would merely lower your credit score, defaulting on a secured loan puts other valuable assets at danger of loss. If you're still wondering, "How can someone with bad credit acquire emergency cash?" That's simple.

You can apply for an installment loan in Texas to receive cash in an emergency. Regardless of your credit score, loan providers can approve the loan and transfer the money to you right away.

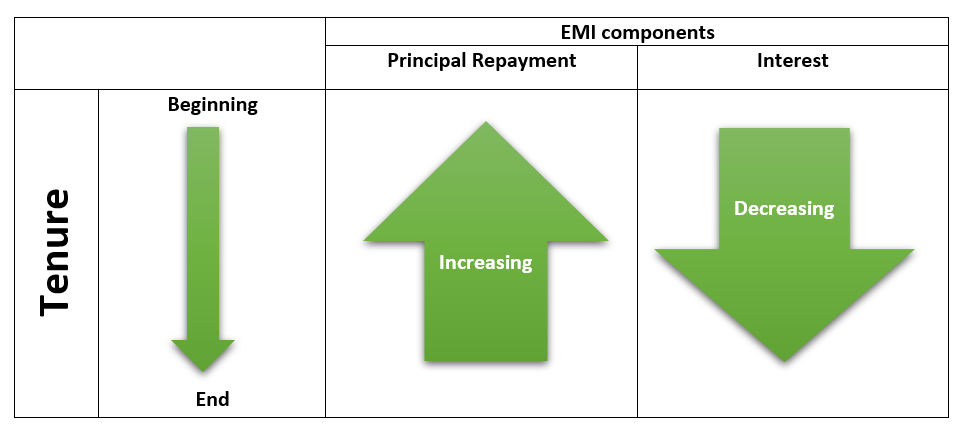

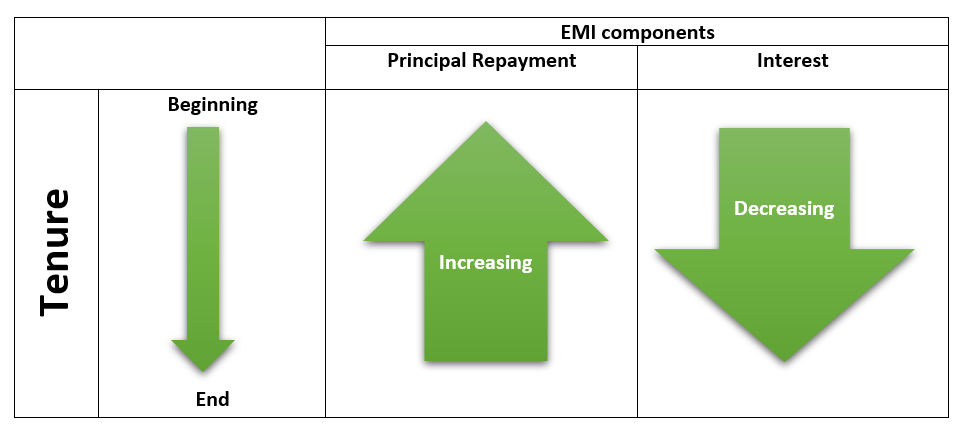

What is An EMI and how it works?

A fixed sum of money that you pay to a bank or lender each month as part of the repayment of an outstanding debt within a predetermined time frame is known as an equated monthly installment (EMI).

Simply described, EMI, or the equated monthly payment, is a service offered by banks and other financial institutions to their clients that allows them to borrow money to meet short-term cash flow demands and then repay it over the course of the loan at a fixed rate of interest. These payments are due from the consumer on a specific day each calendar month. One can use a check to pay the EMI amount or opt for an online option like auto-debit.

The principal repayment and interest make up an EMI. The interest amount makes up a sizeable chunk of the EMI during the first several years. However, as the loan term comes to a close, the principal amount makes up a larger portion of the EMI payment and the interest expense is a much smaller portion.

Installment Loans in Texas FAQ

How do Texas installment Loans work?

An Installment Loan is a long-term type of loan that gives you the opportunity to cover large unforeseen expenses and other needs. You take out a loan in Texas for a certain time and repay it every month in regular installments. As a rule, the loan is unsecured, so you do not need to provide collateral in order to get approval.

Can I get an Installment Loan in Texas with bad credit?

Yes, you can get an Installment Loan in Texas with bad credit, however, remember that you will not be able to get favorable interest rates. Although, you can compare the offers of different installment lenders and choose the most suitable terms.

If you want to be approved, you need to meet certain lender’s criteria. The main ones are a government-issued ID or driver's license, the presence and proof of income, a bank statement, and also your contact information for communication.

As you know, the terms of an Installment Loan repayment in Texas can vary depending on the state of residence and the amount of the loan. As a rule, you can repay the loan from 2 to 24 months. Contact the lender for more information on the repayment terms.

Can I repay the loan earlier?

Yes, you can pay off the Installment Loan before the time specified in the contract. Installment lenders in Texas do not charge commissions and early repayment penalties.