If you're grappling with financial challenges and require emergency funding, you're not alone. Many people find themselves in a similar predicament at some point in their lives. While payday loans might be a common go-to option, they may not be ideal for everyone, especially for those who have a poor credit history or cannot repay the loan amount in a single lump sum.

Installment loans serve as a viable alternative in such scenarios. These loans allow borrowers to repay the borrowed amount over a set period, through scheduled monthly payments. This structure can offer borrowers more breathing room and flexibility in managing their finances.

Apply for Installment Loans online to get guaranteed approval.

Table of Contents

Installment Loan Online for Bad Credit Definition

Indeed, the accessibility and speed of approval are two notable advantages of installment loans, particularly when compared to more traditional forms of lending that often involve more rigorous credit checks and longer processing times.

Key Points:

-

Fast Approval and Fund Transfer: Online lenders often process installment loans quickly, sometimes transferring the funds to your bank account on the same business day you apply.

-

Flexible Credit Requirements: Lenders might be willing to approve applicants who have less-than-perfect credit scores, making this a more accessible option for a wider range of borrowers.

-

No Hard Credit Checks: Many online lenders perform soft inquiries instead of hard credit checks, ensuring that your credit score remains unaffected when you apply.

-

Ease of Application: The application process is typically straightforward, requiring basic personal and financial information, and can be completed online without the need to visit a physical location.

-

Predictable Repayment Plan: Unlike payday loans, which usually require a lump-sum payment in a short period, installment loans offer the convenience of scheduled payments, making it easier to budget and manage your finances.

While these advantages make installment loans a viable option for immediate funding, it's important to be cautious. Always read the terms and conditions, understand the interest rates, and ensure you have a plan to fulfill your repayment commitments. Failure to do so can result in additional fees and a negative impact on your credit history.

Installment loan Calculator

This calculation is just a representative example. The estimates are preliminary and may vary in some cases. You'd better get advice from a finance professional. Using this calculator isn’t a guarantee that you will be eligible for a loan. Your lender will need to approve you.

What is Guaranteed Installment Loan for bad credit?

A Guaranteed Installment Loan for bad credit offers you the ability to cover various personal expenses. Unlike Payday Loans, which require a lump sum repayment, Guaranteed Installment Loans let you make scheduled payments over an extended period. This feature offers the advantage of not having to fully settle your loan by your next payday.

Is it really possible to get a Guaranteed Installment Loan with bad credit history?

Creditworthiness plays a significant role when lenders evaluate loan applications. That's why securing a Guaranteed Installment Loan can pose challenges, especially if you have a problematic credit history. While lenders may not always conduct rigorous credit checks, they usually want to assess your income and employment status to ensure that you can meet your repayment obligations.

However, it's worth noting that having a stable income can increase your chances of securing an installment loan even if your credit history is less than perfect. If you've recently taken steps to improve your credit, that could also work in your favor. Therefore, eligibility for a Guaranteed Installment Loan isn't solely dependent on credit history but involves a range of factors, including your income and the specific loan terms.

Bad credit loans guaranteed approval direct lenders

While you may be looking for guaranteed installment loans from direct lenders, it's important to understand that no loan comes with an absolute guarantee, especially for those with bad credit. Credit bureaus aim to assess risk, so a past default can influence a lender's decision.

However, if you meet the minimum eligibility criteria, which usually include having a steady income and an active bank account, your chances of securing an installment loan are reasonably good. Legal regulations around these types of loans can differ by state, so it's crucial to be aware of local laws that might affect your ability to get a loan.

When it comes to sourcing your loan, you have the option of going through a direct installment lender or a broker. While you might assume that a direct lender would offer better rates, that's not necessarily the case. Both avenues come with their own pros and cons, and the most cost-effective choice may vary depending on your specific circumstances.

Therefore, it's advisable to compare rates and fees from multiple lenders before making a decision. This will enable you to find the most favorable loan terms and help you make an informed choice.

What are the requirements for getting a guaranteed installment loan?

The term "guaranteed" in the context of loans can indeed be misleading. It does not mean there are no requirements or qualifications; rather, it indicates that if you meet a specific set of minimum criteria, your loan application is likely to be approved. These criteria are designed to ensure both the lender's and the borrower's security and form a baseline for financial trustworthiness.

While each lending institution may have unique requirements, there are common criteria most lenders look for:

- Age Requirement: You must be at least 18 years old.

- Citizenship: You need to be a U.S. citizen or a legal resident.

- Income: A steady source of income is usually required to demonstrate your ability to repay the loan.

- Bank Account: An active bank account is typically necessary for the disbursement and repayment of the loan.

- Existing Debt: Most lenders will check if you have other outstanding short-term or cash loans that you have yet to repay.

Meeting these criteria improves the likelihood of loan approval but doesn't eliminate other factors a lender may consider, such as your credit score or additional financial obligations. Therefore, it's essential to read the terms carefully and understand all the requirements before applying for a loan.

Are There No Credit Check Installment Loans Direct Lenders?

When looking for installment loans as a bad credit borrower, lenders that don't perform hard credit checks may be a more viable option for you. These lenders are often more willing to provide instant approval compared to those who conduct thorough investigations with major credit bureaus. Such lenders typically prioritize other factors like your regular income and overall financial stability over your credit score.

However, it's crucial to understand that "fast funding" and "no hard credit check" do not mean the absence of any criteria. You'll still need to prove your creditworthiness through other means, such as demonstrating a consistent income or providing other financial documentation. Therefore, before applying, review the lender's requirements carefully to ensure that you meet them. This approach will increase the likelihood of receiving the funds you need in a timely manner.

When can I Use an Installment Loan?

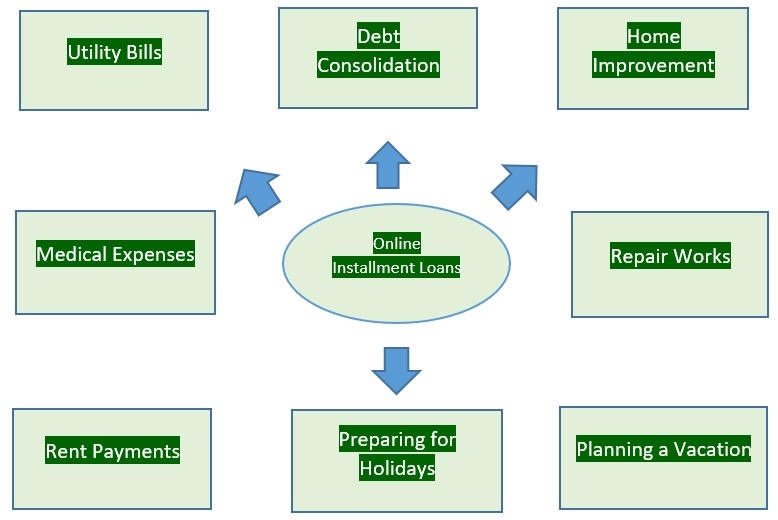

Most customers use online installment loans for bad credit to handle pressing expenses. These can be unexpected costs, house improvements, car maintenance, or even credit card debt reduction. Personal loans that are payable over a longer period in installments are the best option if you need money quickly.

Even if you have a low credit score, you can still rely on direct lenders for installment loans. Instead of performing standard checks, online loan lenders concentrate on your revenue source. It demonstrates your capacity to pay back the loan on schedule. This data is adequate for quick approval.

What Are the Purposes of Online Installment Loans from Direct Lenders?

You can essentially use a loan amount for anything thanks to direct lenders. As a result, you can employ guaranteed installment loans for bad credit to meet any of your present necessities. You should exercise caution while obtaining installment loans, though, as lenders typically charge hefty interest rates. The following are the most typical justifications for obtaining a negative credit loan:

As a result, practically anything can be paid for with online installment loans. If you have low credit, you can still get an installment loan instead of a personal loan.

Advantages of Opting for a Guaranteed Installment Loan

-

Convenient Online Application: Apply quickly online without leaving your home.

-

Expert Guidance: Benefit from knowledgeable assistance for any queries you may have.

-

Direct Lender Partnerships: Work directly with reputable lenders to avoid third-party fees.

-

Robust Data Security: Your personal information is protected with top-tier security measures.

-

Unsecured Loans: No need to risk your assets, as all loans are unsecured.

Each of these points offers a distinct benefit, aiding you in making a well-informed decision about securing a guaranteed installment loan.