Installment lending is still very popular in many parts of America. 12 million people still use them yearly. Every state has its right to regulate the industry within their borders. Therefore 50 different principles exist and each of it varies from complete prohibition to no limitations at all. This article is an explanation of the Georgia, New Jersey and Virginia installment loan laws.

Installment lending in Georgia

Loan laws of Georgia are a perfect example of clear limitations that restrict lenders within the state. Do not hesitate to check out the original legislation. The Georgia lending laws are way stricter and more effective than those in other states. The government controls lending rates. It effectively eliminates lenders in the state. Acting improperly is a crime in Georgia and punishable by jail time.

Installment Loan for bad credit in Georgia

No requirement of a traditional credit check from lenders exists in Georgia. Currently, financial organizations only check if you are able to refund the loan within the specified term. The term is usually a maximum of 3 months. That is why if you have a permanent employment it can assist you to avail Installment Loan for bad credit in Georgia. The process of application is fast and secure, no paper work is involved and you get money immediately in most cases.

Installment Lending in New Jersey

Money markets in The US are filled with online connecting platforms that support network services. The problem appears when the debtors start to look for organizations with more or less competitive terms. Absolutely acceptable regulations of any company should arouse suspicions. Before submitting an application in order to get the money you first need to check the trustworthiness of the organization and only after that start the borrowing process.

What can you do in the situation when you are doubting lawfulness of a lender? Ask for official authorization. Remember that every legitimate lender must have an authentic license confirming with state law or regulations.

How does Installment Loan in New Jersey work?

Online Installment Loan in NJ gives you the answer. 12 months is the standard maturity of Online Installment Loans in New Jersey. It is also possible to take out this kind of loans for 6 months. If you refund every month, you will end up making 11 payments. If you get paid every 2 weeks, you will end up paying 23 payments.

Interest rate. All Online Installment Loans have higher interest rates than regular loans. Therefore, they are not suitable for needs that require long-term payments.

Loan amount. The loan amount, as well as the interest rate, individual indicators. The allowed loan amount depends on the amount of your income.

Virginia Installment Loan with No Credit Check

No credit or even bad credit score is not an obstacle to get the money you applied for. The process of application for Virginia Installment Loan with No Credit Check is always simple and secure. Applying online guarantees you to get the necessary sum of money straightaway. All you need to provide is your authentic information and proof of steady income. On the set due dates, the repayments are made automatically.

Installment loan lets you take quite big amount of money and return it by fixed payments within the period of few months. Installment Loans have fixed interest rate for the entire period of refunding. Moreover, this kind of loan will not last endlessly. Installment Loans are paid in equal installments each month. Before you decide to apply, analyze what sum you can save each month for the repayment of the Installment Loan. This is important to avoid getting stuck in debt and pay off the loan on time. Check Installment Lending on Maggie Loans for more detailed information about terms and rights.

Installment Loans 2020-2022 Changes

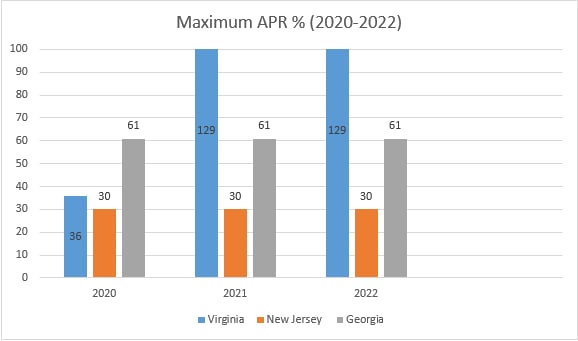

Let's look at the table below to see how the cost of Online Installment Loans in Georgia, New Jersey and Virginia have changed:

As statistics show, APR has grown only in Virginia. The other two states maintain the same level of interest rates for Installment Loans. It means they are regulated by law and the prices are capped.