In 2022 we can observe a tremendous growth of inflation up to 8,4% which naturally affects interest rate, especially the real one. If you are an investor, or a lender, or other banking institution, you should know the difference between the nominal and real interest rates and calculate your profit accordingly.

Let’s discover what interest banks set up, how real rate differs and how inflation influences this factor.

Table of Contents

What is the nominal interest rate?

A nominal interest rate is the rate charged for a savings account, mortgage or other loans, for example, unadjusted to inflation. It doesn’t actually show the real cost of the product you are going to borrow or invest into. It just lets you have some idea of the price of money and allows to understand the state of the market. The nominal interest lies under the impact of Fed mainly. Due to this figure you can find out the amount of money you will be charged for a loan or you will get from your savings.

Talking about loans, the nominal rate will represent how your loan interest will raise in per cent for the financing you get. For example, if you apply for same day loans online from a direct lender doing no credit check, you borrow from $100 to $1,000 instant cash and a lender is to earn 29% interest on every $100 borrowed, and as a result when the loan is due, you have to pay back $100 pf the principal plus $29 in interest – total cost of the loan will be $129.

What is the Real Interest Rate?

A real interest rate is adjusted for inflation. It provides a clear price of money and its purchasing power. Due to the real interest rate, lenders or investors can understand how much they are going to earn with every financial operation. For example, the lender planned to make 10% or $10 on the $100 loan. However, because inflation was 3% over this term, the real earnings of the lender was 7% in real purchasing power or $7 on the $100 loan.

To calculate the real interest rate, we need to use the following formula:

Real interest rate = nominal interest rate - rate of inflation

Let’s check how these two factors (real interest rate and inflation rate) have been changing over the latest years and what is the interrelation between them.

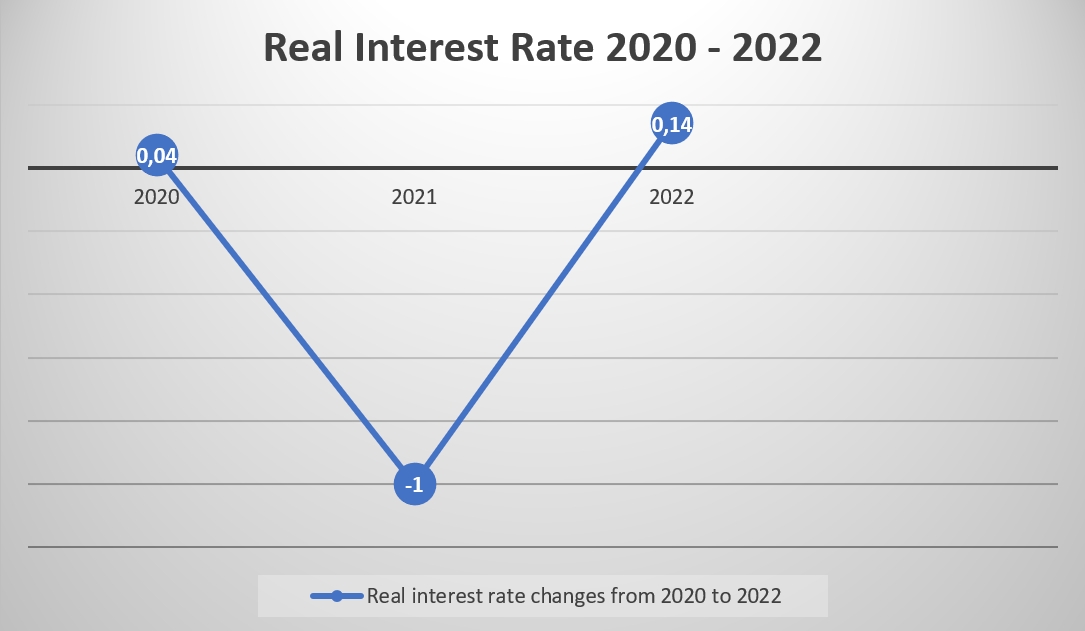

Real Interest Rate USA 2020 – 2022 Changes

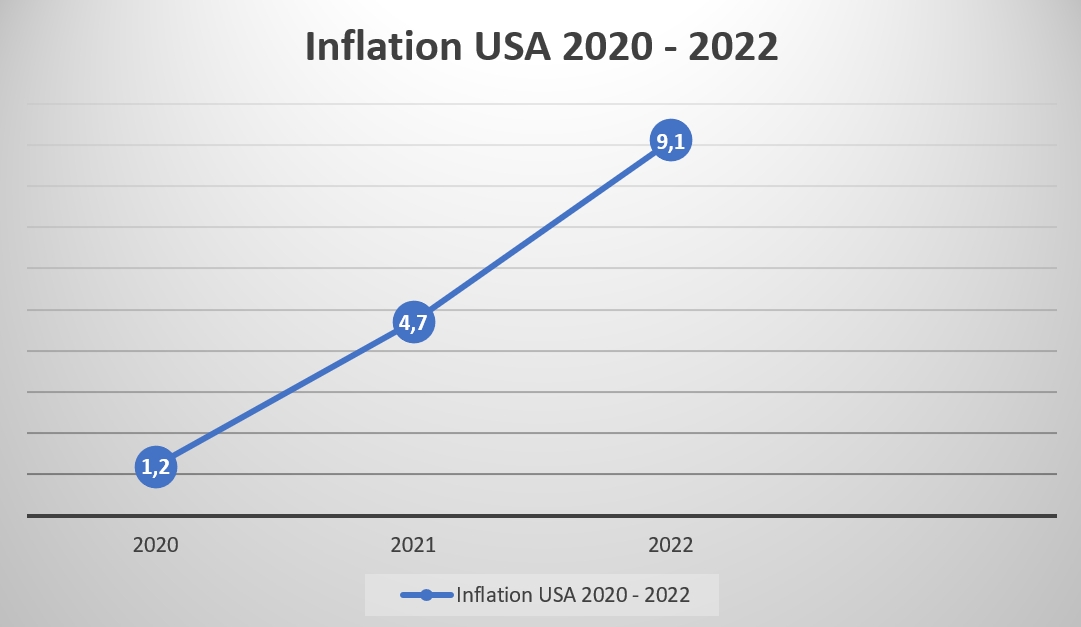

Inflation Rate in the USA 2020 – 2022

To sum up

Fed establishes the nominal interest rate which is current rate. But when you plan to invest or lend or borrow money, you need to know what interest you’ll get or pay overtime. It means we need to take into account the inflation, i.e. to adjust the nominal interest rate to the inflation rate. Thus, we get the real interest rate which is more important in the real world of finance.

What Factors We Should Consider for the Real Interest Rate

·Expected Inflation Rate

Expected inflation rate is the rate of purchasing power of a given currency decrease within some term in the future.

The expected rate of inflation for the next 3 years is reported to Congress by the Federal Reserve (Fed).

When you are going to invest or lend some money, pay attention to both current and expected inflation rates.

·Purchasing Power

Purchasing, or currency's buying power, is determined by the number of goods one can buy for a certain value of currency.If the inflation rate tends to increase, the purchasing power is to become lower.

What is the difference between the nominal and real interest rates?

Let’s sum up the information and conclude what the difference between these two types of interest – nominal and real interest rates is:

|

Parameters of Comparison |

Nominal Interest Rate |

Real Interest Rate |

|

Meaning |

Shows the market rate at the current time |

Shows the real amount of money the investor or lender will make |

|

Inflation adjustment |

Adjusted only to the inflation of the previous financial year |

Adjusted for the current inflation rate |

|

Stability |

Stable |

Not stable, adjusted to the inflation |

|

Measure |

Only positive |

Both positive and negative depending on the inflation |

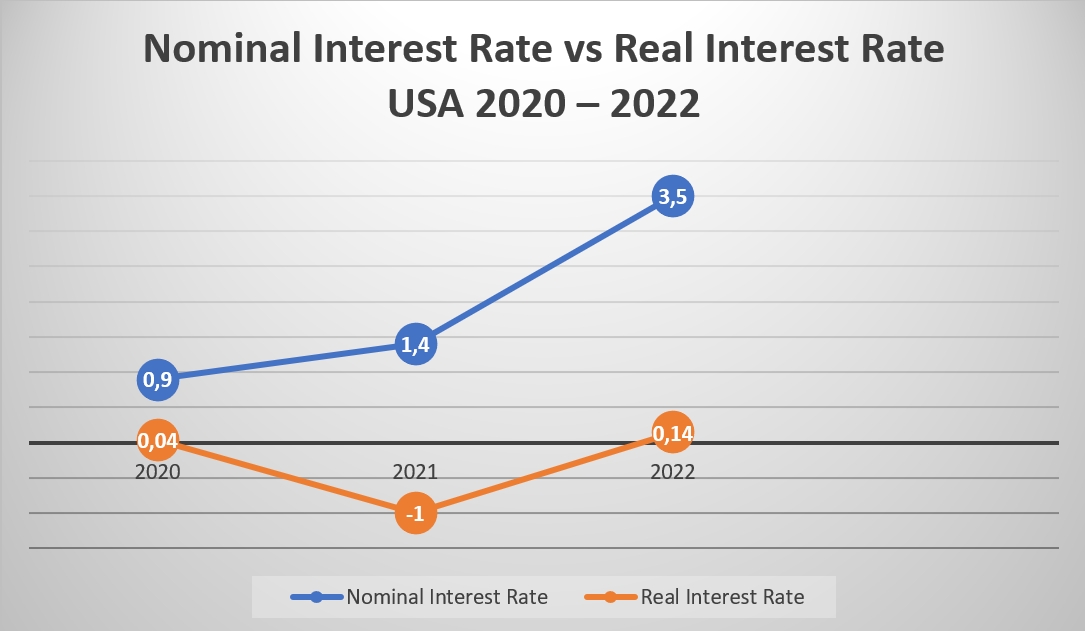

Nominal Interest Rate vs Real Interest Rate USA 2020 – 2022

As we can see on the diagram, real interest rate is lower than the nominal one. It’s logical provided the inflation is growing. Another tendency shows both rate types have increased significantly since 2020. It can be explained by a terrific rise if inflation rate nowadays.

It’s important to know the real interest rate as it’s the one that will provide you with the true cost of our loan or true income of your investment. For example, if you plan to apply online for a $500 loan, the nominal interest will only tell you how much you owe for this cash advance now. And the real interest will give a clear idea how much you’ll have to repay when the loan is due. As a result, you’ll be able to choose the best 500-dollar loan lender with the cheapest rates.

The Key Points

- Taking a financial decision, you need to take into account both nominal and real interest rates.

- Nominal interest rate will show you only the current amount of finance charges.

- Real interest rate will consider inflation rate predicted for the future and provide you with the real cost of the product overtime.

- A positive real interest rate would indicate more purchasing power.

- A negative real interest rate would result in lower purchasing power.

- If you are going to apply for a loan, negative real interest rates would mean that you will have to pay less in interest within the term of the loan.

- The nominal interest rate is important for investors and helps them to analyze the market and decide where to invest their money.