More and more loan companies in California are offering secured loans. Many people immediately associate them with mortgage loans and a pledge of real estate or a pawnshop. However, these associations are not entirely correct. Loan companies do not lend as huge amounts as banks do with mortgage loans. They are also not comparable to pawnshops, the activity of which is unregulated and you have to leave there an item which value is much higher than the amount received, until a specified repayment period. Secured loans are offered not only by banks, but also by non-bank companies. Their offer is so competitive that private and cheap non-bank loans are more and more often selected. Why? Because it pays off.

Loans without checking the debtors' database in California

Secured loans are loans for people who find themselves in a difficult financial situation, which translates into low creditworthiness. This prevents them from taking out a standard non-bank loan or bank loan. Title loans are often referred to as loans without credit check, for bad credit or loans without income certificates.

A vehicle is a collateral for a loan company that borrows money from its own capital. The loan company makes the decision to grant a loan mainly on the basis of information about the object to be pledged. However, most companies still control our situation in the debtors' databases.

Each of the companies offering this type of product creates its own set of conditions regarding the types of pledged items, their age and technical condition. The most popular forms of secured loans in California are car title loans. In this case, the most important conditions that must be met by the borrower are owning the car and not establishing other securities on the car.

Car title loan in California

The most sensible choice among secured loans in California seems to be car loans. The car remains in the owner's use all the time, while for the duration of the loan agreement, an entry is added to the registration certificate that the loan company becomes its co-owner. This entry will be canceled when the consumer repays the loan. The cancellation of the entry is guaranteed by the provisions in the contract, which is signed by both the borrower and the company's representative. The valuation of the car to be pledged is carried out by an external, specialized company. This gives the borrower a guarantee that the service is reliable.

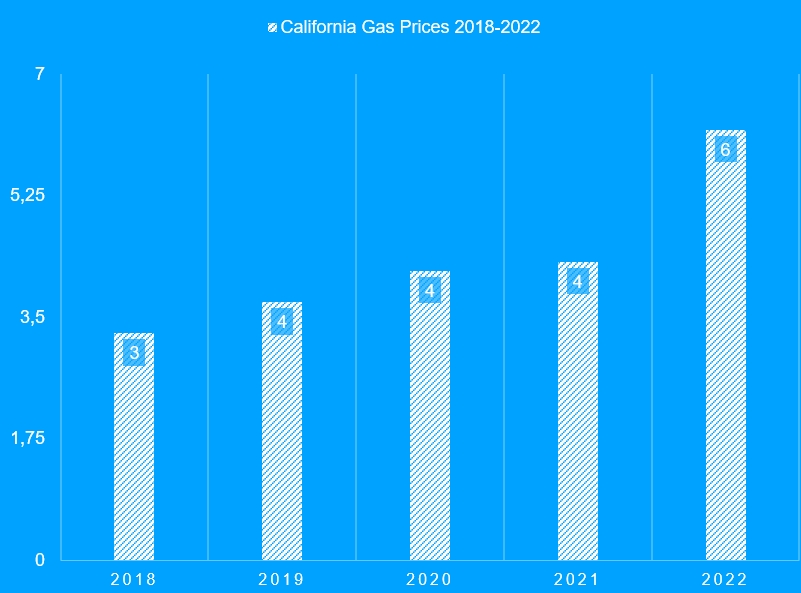

Gas prices growth in California

While the popularity of title loans in California is growing every day, gas prices are also rising every day, as can be seen in the chart below.

It is worth noting that California is the region with the most expensive fuel in the country, so it is becoming more and more expensive to have a car in California. That is why it is speculated that in the near future, many people will no longer be able to afford to maintain a car and, accordingly, take a title loan. Most likely, the number of bikers in California will increase, as this is the cheapest method of transportation and, among other things, has a positive effect on health.

A title loan is the first step to getting out of debt

Most experts in the financial industry recommend using a common and cheap non-bank title loan. If you find car title loans near me, this is the first step to getting out of debt. Thanks to a large and quick injection of cash, a person looped in debts repays them instantly. He avoids bailiffs' execution, the property accumulated throughout his life is still in his hands. Debts are converted into low monthly installments that do not overburden his budget. Private non-bank title loans in California are the best solution for people in debt, both at the stage of initial financial problems and when we are already dealing with a bailiff. Of course, it's best to avoid court costs and bailiff's visits because this only multiplies the costs and increases the debt. Therefore, when the problem with the repayment from month to month recurs, do not wait! Private and cheap non-bank loans secured by vehicle allow you to repay the debt and, as a result, we have one obligation and one installment a month to pay.

High amounts of title loans

Title loans are characterized by high amounts. Without collateral, obtaining a loan in the amount exceeding $10,000 may prove problematic, especially if we have low earnings or we do not have an employment contract. The title significantly increases the loan amount. Are there any restrictions? In principle, there are no restrictions, it all depends on what car we have. If we are the owners of a car valued at thousands of dollars, the amount of the loan will be determined accordingly to this amount. Very high amounts can be borrowed against title loans, and this is another undoubted advantage of them. A high amount is the possibility of financing a specific investment or repayment of debts and obtaining additional cash.

Co-ownership

Everyone who owns a vehicle can get instant online car title loan in California. The only thing you need to pay attention to is that in California there is a law that from the moment the transaction is concluded until the moment the full amount of the loan is paid, the lender becomes the owner of 51 percent of the ownership of the car. At the same time, a borrower can continue to drive a car and use it freely, but he cannot sell it or transfer ownership to someone else.

Money quickly available

The investment will not wait, and neither will the creditors. Private companies have developed a quick scheme of action when granting title loans. You can take advantage of the bank's offer, but the amount of formalities at the beginning effectively scares you off. Private and cheap non-bank title loans are granted quickly. Usually, within 24 hours of sending the documents, there is a decision. And over the next 24 hours, the money is transferred to the account. Lenders usually require basic documents, such as:

- have American citizenship;

- have full legal capacity;

- have a valid identity card, phone number and e-mail;

- be over 18 years old;

- be the only owner of the car that will be the collateral for the loan (this will be confirmed by the vehicle registration certificate).

After that, it is enough to complete a short application and the money is deposited to the account within a few days. Private non-bank title loans in California have the advantage over bank loans that they do not require a file of documents and several weeks of waiting for an answer.