Table of Contents

Online Installment Loans in Georgia

Do you need urgent money? Here you can get Online Installment Loans in Georgia from a reliable lender in 24 hours. Our Online Installment Loans will help you cope with a difficult financial situation.

If you take Online Installment Loan Instant Approval in Georgia, please contact us immediately. We work only with direct lenders that have the state's license to offer Installment Loans to Georgia residents.

Our professional team works for you 7 days a week. You can contact us at any time and ask all your questions about Online Installment Loans.

How to get Online Installment Loans in Georgia?

-

Apply online.

-

Get instant approval.

-

Receive your money within

Installment loan Calculator

This calculation is just a representative example. The estimates are preliminary and may vary in some cases. You'd better get advice from a finance professional. Using this calculator isn’t a guarantee that you will be eligible for a loan. Your lender will need to approve you.

APPLY NOW

What is Georgia Installment Loan?

Online Installment Loans in Georgia differ in terms of maturity, interest rate, and loan amount.

-

The maturity of the loan. The standard maturity of Online Installment Loans in Georgia is 12 months. You can also take out such loans for 6 months. If you get paid every month, you will end up making 11 payments. If you get paid every 2 weeks, you will end up paying 23 payments.

-

Interest rate. The annual interest rate is individual and varies depending on your specific characteristics. For example, the interest rate depends on your credit history. All Online Installment Loans have higher interest rates than regular loans. Therefore, they are not suitable for needs that require long-term payments.

-

Loan amount. The loan amount, as well as the interest rate, are individual indicators. The allowed loan amount depends on the amount of your income.

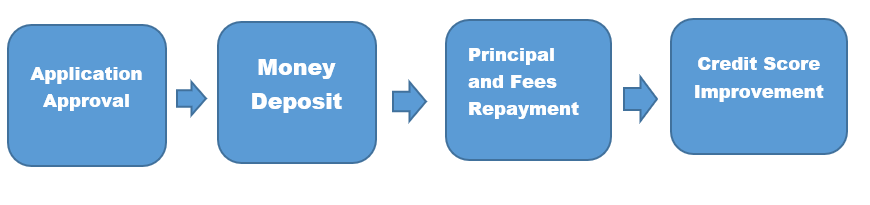

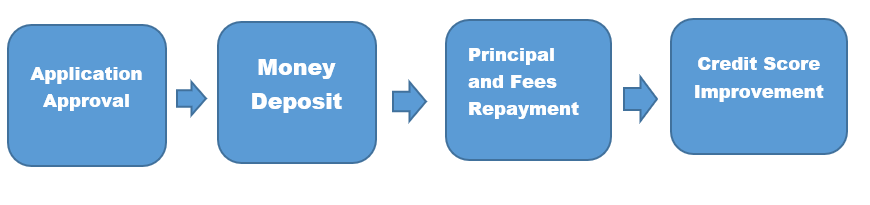

How do installment loans work?

The money is deposited into your bank account after the lender approves your application for an installment loan. The loan balance plus interest is then paid back during the period specified in your loan agreement.

Who Qualifies for Installment Loans in Georgia?

To get Online Installment Loans in Georgia, you must:

-

Be a resident of Georgia.

-

Be of age.

-

Have a permanent source of income.

-

Have an active Bank account.

-

Be a permanent resident or citizen of the United States.

-

Have an active email address and a valid contact number.

What institutions provide installment loans?

Installment loans in Georgia are available through banks, credit unions, and online lenders. Find the lender with the best rates, conditions, and loan features by comparing them all.

-

Banks

Unsecured installment loans are provided by some national banks. If yours does, it's probably a good idea to start doing some comparison shopping, as banks occasionally provide established customers better rates or lenient borrower requirements.

-

Online lenders

Online lenders serve a variety of clients. While some offer loans for borrowers with bad credit, others work with those with excellent credit. You may pre-qualify with the majority of online lenders to determine what rate, period, and monthly payment you are eligible for. Pre-qualification has no impact on your credit score, allowing you to compare offers from different lenders.

-

Credit unions

Because federal credit unions have an 18% APR cap, members may have access to low-rate installment loans. On a loan application, credit unions could consider your membership status in addition to your credit history, which might increase your chances of approval.

How to choose the best installment loan option?

Select a loan that gives you control over your finances to take responsibility of your money. By contrasting payment plans, interest rates, and periods, determine which installment loan best meets your needs.

By locating the most suitable installment loan, you can reclaim your financial future.

Compare the following features:

|

Accessibility

|

You ought to have easy access to the money you need, wherever you need it, thanks to the installment loan.

|

|

Type of loan

|

Installment loans come in both secured and unsecured varieties. Unsecured loans don't require collateral, while secured loans do, such an automobile.

|

|

Terms of repayment

|

Your monthly loan payments should be within your means. You may be able to effectively repay your debt if you make affordable payments

|

|

Annual Percentage Rate

|

Check your lender's annual percentage rate (APR) to see whether there are any origination, late, or prepayment costs.

|

|

Opportunities for improving credit

|

Paying on time ought to get you the credit you merit and could raise your credit score. Pick a lender that informs the credit bureaus about repayments.

|

What are the benefits of Installment Loans in Georgia?

-

Fixed rate of interest

-

You have the possibility to raise your credit score if you make your payments on time

-

More money borrowed than with payday loans

-

Fixed costs

-

No early payment fee

FAQ Installment Loans in Georgia

How do Installment Loans in Georgia work?

An Installment Loan is a long-term type of loan that gives you the opportunity to cover large unforeseen expenses and other needs. You take out a loan in Georgia for a certain time and repay it every month in regular installments. As a rule, the loan is unsecured, so you do not need to provide collateral in order to get approval.

Can I get an Installment Loan with bad credit?

Yes, you can get an Installment Loan in Georgia with bad credit, however, remember that you will not be able to get favorable interest rates. Although, you can compare the offers of different installment lenders and choose the most suitable terms.

As you know, the terms of an Installment Loan repayment in Georgia can vary depending on the state of residence and the amount of the loan. As a rule, you can repay the loan from 2 to 24 months. Contact the lender for more information on the repayment terms.

Are there any early prepayment fees?

No, you can pay off the Installment Loan before the time specified in the contract. Installment lenders in Georgia do not charge commissions and early repayment penalties.